Market’s patience and confidence has been depleting. Many of the “industry leaders” and “white horses” stocks that everyone loved a few years ago have seen their share prices halved. Kweichow Moutai down 31%, China Merchants Bank down 49%, PingAn down 54%, CATL down 57%, Longi down 68% and Eve Energy down 72% since 2021. The trading volume has been light, misleading the investors to believe that the stocks had bottomed, but another wave of decline quickly followed. The China stock market has been dropping for three consecutive years, combined with the weakening expectations for future economic growth. The pessimism is accumulating, while the patience and confidence is depleting and drying up.

The market becomes even more suffering as it approaches to the end of the bear cycle. The end of the bear cycle was usually marked with lack of market confidence, extremely thin trading volume and little reaction to positive news. Looking back at the time when SHCOMP index dropped below 1000 in June 2005, a month before the end of the bear market, the headlines in the newspapers were “There Was Nothing Worse Than Apathy”, “Core Assets Broken Up Completely”, “Value Investing Is Dead”, “Funds Alliance Broken Down”, and “Systemic Regulation Is Needed to Guarantee Investors’ Reasonable Income”. All these headlines could be used 20 years later and fit in today’s background. This reflects the cyclicality of the market as well as the characteristics of the end of the bear market – it is the darkest and the most suffering time.

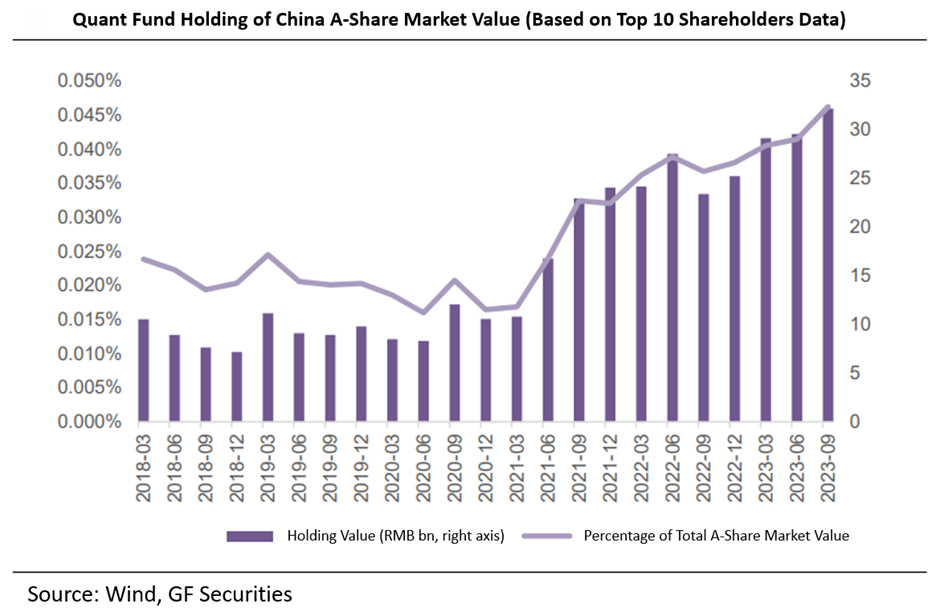

Discretionary long-only strategies have suffered the most. Different from the previous bear market, the performance contrast between quant index enhancement products and the long-only products is the new phenomenon this time around. Quant strategies have completely outperformed over the past three years with higher alpha and smaller drawdown. There is cyclical as well as secular reasons behind it. On the one hand, 2021Q1 was the peak of big-cap growth style and fundamental strategies’ performance cycle since most fundamental funds held concentrated bets in those big-cap growth names. The past three years saw the market style shift away from big-cap growth names. The “Moutai Index” was down 40%, while the “CATL Portfolio” was down more than 50% since 2021. It was nearly impossible to avoid this cyclical style downturn via stock selection. The secular reason behind the rise of the quant strategies is long-term trend shift away from the traditional discretionary strategy. Taking US market as a reference, the market share of quant strategies will continue to increase going forward. Discretionary strategies saw fund redemption, and had to sell stocks at low, which in turn caused the fund NAV to go down further and trigger more fund redemption, trapped in a downward spiral. Quant strategies received subscription, and had more capital to add on to their existing small-mid-cap positions, and leading to further share price rise. The capital move from traditional discretionary to quant funds aggravated the performance differences.

It hurts most to see our long-term investors redeeming funds at low valuation. We got to know a lot of long-term clients over the past ten years and they have been giving us tremendous help and support. We have built strong trust and friendship with these clients after years of collaboration and have always enjoyed high retention rate of investors. However, since the second half of 2023, some of our long-term investors also started to redeem. We understand the challenges our investors are facing in the past three years, while we feel bad that we weren’t able to avoid the market downturn and our investors had to redeem at low valuation. We hope one day we will have the chance to make up to these investors.

Market competition is cruel and only the fittest survives. This is the truth of the market. Thanks to the market competition, the efficiency can be improved, the share price can be corrected and the capital allocation can be optimised. We can’t be fearful of market competition while asking for more market-oriented economy. The only way for discretionary managers to survive is to increase one’s own competency.

Rather than waiting out the bear market, actively transformation should be the way to go. The past 30-year discretionary investment experience could be turned into treasure for the new investment approach rather than burden. Over the past three years, we learned and explored three ways to combine the advantages of discretionary and quant investments.

First, active logic combined with quant validation. We combine the clear investment logic behind the discretionary strategy and the advantage of back-testing ability of quant strategy, and incorporated fundamental logic into our multi-factor quant model.

Second, quant screening combined with active stock selection. We combine the full-market coverage advantage of quant strategy and our in-depth research and knowledge of individual stocks and sectors.

Third, active market timing and quant stock picking. We combine the strength of discretionary strategy on market timing and style shift with quant model’s stock picking. Implementing quant stock selection based on active assessment of long-term market trend and style rotation.

These methods have been fully applied in our investment and have been effective. Every new year is the start of another round of competition. We have new investment idea and approach, and have completed the transformation of the investment team and the methodology. We are confident to be tested by the market.

This winter has been unusually long. But it wouldn’t stop us from learning and being prepared for the future.

Spring will come eventually.